Different types of capital market instruments

What is IPO

An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. An IPO allows a company to raise capital from public investors.

The transition from a private to a public company can be an important time for private investors to fully realize gains from their investment as it typically includes a share premium for current private investors

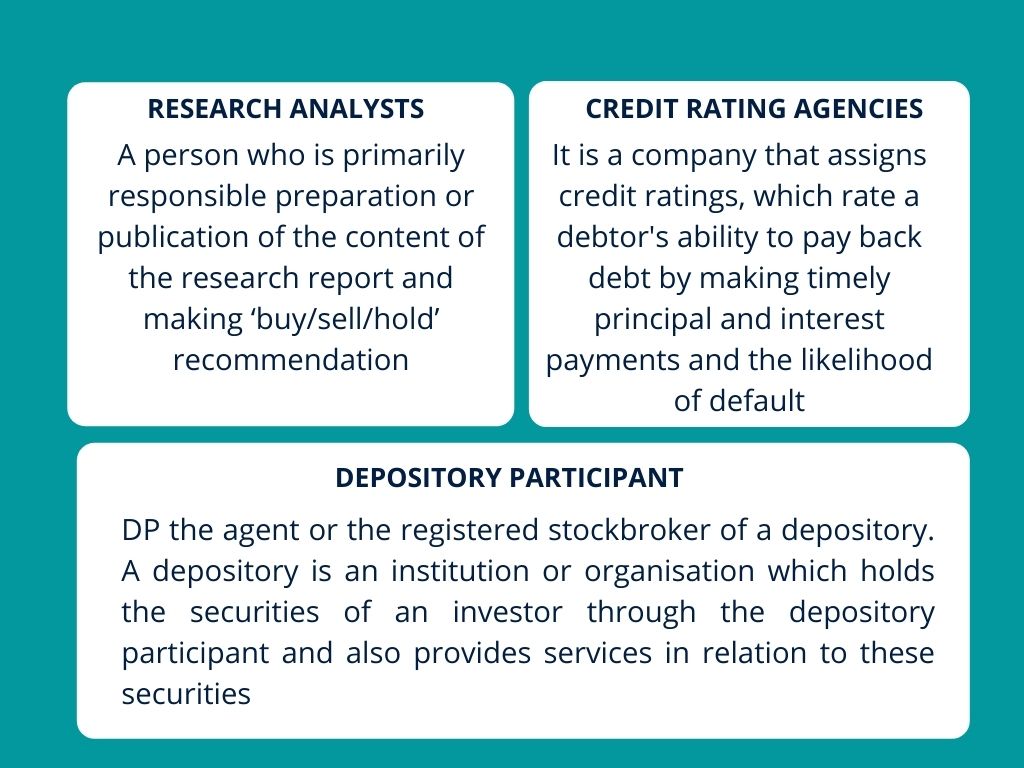

Who are the top credit rating agencies?

FAQ on Credit Rating Agencies

What is methodology in credit rating?

Manufacturing Companies | Financial Services Companies | Structured Obligations |

Industry Risk | Capital Adequacy | Structured borrowing arrangements |

Company’s industry and market position | Asset Quality | legal and tax structure |

Operating efficiencies | Management | Ability and |

Accounting Quality | Earnings | Securitization transforms illiquid assets |

Financial flexibility Fixed at par | Liquidity | overall risk |

Earnings protection | Systems and Control | pool and the cash flows |