Products in Derivatives Market

Forwards

It is a contractual agreement between two parties to buy/sell an underlying asset at a

certain future date for a particular price that is pre-decided on the date of contract.

Both the contracting parties are committed and are obliged to honour the transaction irrespective of price of the underlying asset at the time of delivery.

Since forwards are negotiated between two parties, the terms and conditions of contracts are customized. These are Over-the-counter (OTC) contracts

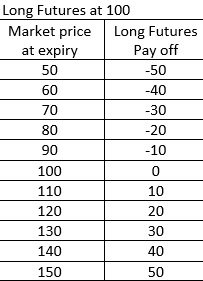

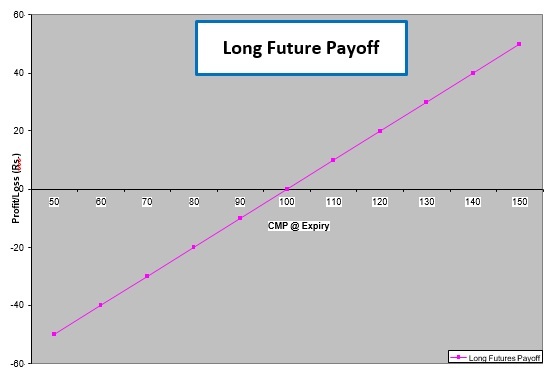

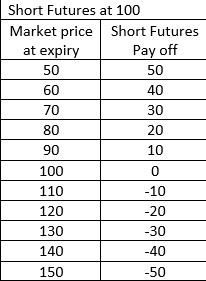

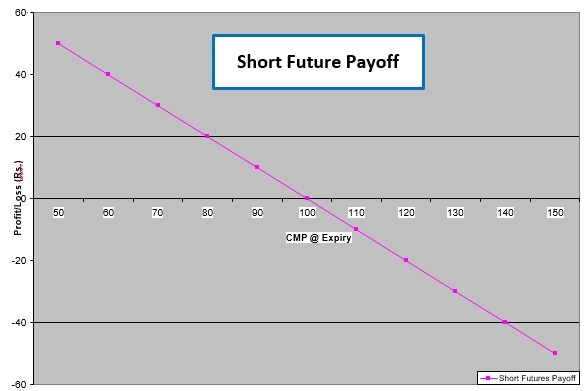

Futures

A futures contract is similar to a forward, except that the deal is made through an organized and regulated exchange rather than being negotiated directly between two parties. Indeed, we may say futures are exchange traded forward contracts

Options

An Option is a contract that gives the right, but not an obligation, to buy or sell the underlying on or before a stated date and at a stated price. While buyer of option pays the premium and buys the right, writer/seller of option receives the premium with obligation to sell/ buy the underlying asset, if the buyer exercises his right.

Swaps

A swap is an agreement made between two parties to exchange cash flows in the future according to a prearranged formula.

Swaps are, broadly speaking, series of forward contracts. Swaps help market participants manage risk associated with volatile interest rates, currency exchange rates and commodity prices.