Table of Contents

ToggleCapital Market Products

NSE started trading in the equities segment (Capital Market segment) on November 3, 1994 and within a short span of a year became the largest stock exchange in India in terms of volumes transacted. NSE is ranked as the third largest stock exchange globally in terms of number of equity trades, as per World Federation of Exchange (WFE) Report – 2019.

An Index is used to give information about the price movements of products in the financial, commodities or any other markets. Financial indexes are constructed to measure price movements of stocks, bonds, T-bills and other forms of investments. Stock market indexes are meant to capture the overall behaviour of equity markets.

A mutual fund is a pool of money managed by a professional Fund Manager. It is a trust that collects money from a number of investors who share a common investment objective and invests the same in equities, bonds, money market instruments and/or other securities.

In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the underlying. Some of the more common derivatives include forwards, futures, options, swaps.

Equities

Trading Introduction

NSE introduced for the first time in India, fully automated screen based trading. It uses a modern, fully computerised trading system designed to offer investors across the length and breadth of the country a safe and easy way to invest.

The NSE trading system called ‘National Exchange for Automated Trading’ (NEAT+) is a fully automated screen based trading system, which adopts the principle of an order driven market.

The NSE trading system called ‘National Exchange for Automated Trading’ (NEAT+) is a fully automated screen based trading system, which adopts the principle of an order driven market.

The Exchange operates the following sub-segments in the Equities segment:

In a rolling settlement, each trading day is considered as a trading period and trades executed during the day are settled based on the net obligations for the day.

At NSE, trades in rolling settlement are settled on a T+2 basis i.e. on the 2nd working day. For arriving at the settlement day all intervening holidays, which include bank holidays, NSE holidays, Saturdays and Sundays are excluded.

Typically trades taking place on Monday are settled on Wednesday, Tuesday’s trades settled on Thursday and so on.

At NSE, trades in rolling settlement are settled on a T+2 basis i.e. on the 2nd working day. For arriving at the settlement day all intervening holidays, which include bank holidays, NSE holidays, Saturdays and Sundays are excluded.

Typically trades taking place on Monday are settled on Wednesday, Tuesday’s trades settled on Thursday and so on.

Pursuant to the directive of SEBI to provide an exit route for small investors holding physical shares in securities mandated for compulsory dematerialised settlement, the Exchange has provided a facility for such trading in physical shares not exceeding 500 shares.

This market segment is referred to as ‘Limited Physical Market’ (small window). The Limited Physical Market was introduced on June 7, 1999.

This market segment is referred to as ‘Limited Physical Market’ (small window). The Limited Physical Market was introduced on June 7, 1999.

Trading in this market segment is available for institutional investors only. In order to ensure that the overall FII ceiling limits are not violated, trading members shall be allowed to enter sell orders in this market segment only for their FII clients. However, members can enter buy orders on behalf of FII/FI clients.

SEBI vide circulars CIR/ IMD/FII&C/3/2012 dated January 13, 2012, CIR/ IMD/ FII&C/ 4/ 2012 dated January 25, 2012, provide a guideline for Investment by Qualified Foreign Investors (QFI) in Indian Equity Shares.

As per the SEBI circular, when the aggregate shareholding of all the QFIs in a company reaches 8% of the equity paid-up capital, the company’s name along with ISIN shall be published in caution list by the depositories and no fresh purchases shall be allowed without prior approval of the depositories.

As per the SEBI circular, when the aggregate shareholding of all the QFIs in a company reaches 8% of the equity paid-up capital, the company’s name along with ISIN shall be published in caution list by the depositories and no fresh purchases shall be allowed without prior approval of the depositories.

The scrips in Trade for Trade segment are made available for trading under BE series. The settlement of scrips available in this segment is done on a trade for trade basis and no netting off is allowed.

The criteria for shifting scrips to/from Trade for Trade segment are decided jointly by the Stock Exchanges in consultation with SEBI and reviewed periodically.

The process of identifying the securities moving to Trade for Trade segment is done on a fortnightly basis while securities moving to/from Trade to Trade is done on a quarterly basis. This review is applicable to all securities irrespective of Price Bands.

The criteria for shifting scrips to/from Trade for Trade segment are decided jointly by the Stock Exchanges in consultation with SEBI and reviewed periodically.

The process of identifying the securities moving to Trade for Trade segment is done on a fortnightly basis while securities moving to/from Trade to Trade is done on a quarterly basis. This review is applicable to all securities irrespective of Price Bands.

The SEBI vide letter MRD/DoP/SE/Cir – 19/05 dated September 02, 2005 and CIR/MRD/DP/118/2017 dated October 26, 2017 guidelines outlining a facility of allowing Stock Exchanges to provide a separate trading window to facilitate execution of large trades.

The Exchange has introduced a new block window mechanism for the block trades from January 01, 2018.

The Exchange has introduced a new block window mechanism for the block trades from January 01, 2018.

In accordance with SEBI letter SMD/Policy/9916/2003 dated May 20, 2003 notifying scheme / guidelines outlining a facility of providing Trading Session after normal market hours in Capital Market Segment, ‘Closing Session’ has been introduced by the Exchange from June 16, 2003.

START YOUR INVESTMENT BANKING CAREER

Equity Trading

Introduction

NSE introduced for the first time in India, fully automated screen based trading. It uses a modern, fully computerised trading system designed to offer investors across the length and breadth of the country a safe and easy way to invest.

The NSE trading system called ‘National Exchange for Automated Trading’ (NEAT+) is a fully automated screen based trading system, which adopts the principle of an order driven market.

The NSE trading system called ‘National Exchange for Automated Trading’ (NEAT+) is a fully automated screen based trading system, which adopts the principle of an order driven market.

Market Segments

The Exchange operates the following sub-segments in the Equities segment:

In a rolling settlement, each trading day is considered as a trading period and trades executed during the day are settled based on the net obligations for the day.

At NSE, trades in rolling settlement are settled on a T+2 basis i.e. on the 2nd working day. For arriving at the settlement day all intervening holidays, which include bank holidays, NSE holidays, Saturdays and Sundays are excluded. Typically trades taking place on Monday are settled on Wednesday, Tuesday’s trades settled on Thursday and so on.

At NSE, trades in rolling settlement are settled on a T+2 basis i.e. on the 2nd working day. For arriving at the settlement day all intervening holidays, which include bank holidays, NSE holidays, Saturdays and Sundays are excluded. Typically trades taking place on Monday are settled on Wednesday, Tuesday’s trades settled on Thursday and so on.

Pursuant to the directive of SEBI to provide an exit route for small investors holding physical shares in securities mandated for compulsory dematerialised settlement, the Exchange has provided a facility for such trading in physical shares not exceeding 500 shares. This market segment is referred to as ‘Limited Physical Market’ (small window). The Limited Physical Market was introduced on June 7, 1999.

Salient Features of the Limited Physical Market

(a). Trading is conducted in the Odd Lot market (market type ‘O’) with Book Type ‘OL’ and series ‘BT’.

(b). Order quantities should not exceed 500 shares.

(c). The base price and price bands applicable in the Limited Physical Market are same as those applicable for the corresponding Normal Market on that day.

(d). Trading hours are the same as that of the normal market and order entry during the pre-open and post-close sessions are not allowed.

(e). Settlement for all trades would be done on a trade-for-trade basis and delivery obligations arise out of each trade.

(f). Orders get matched when both the price and the quantity match in the buy and sell order.

(g). Orders with the same price and quantity match on time priority i.e. orders which have come into the system before will get matched first.

(h). All Good-till-cancelled (GTC)/Good-till-date (GTD) orders placed and remaining as outstanding orders in this segment at the close of market hours shall remain available for next trading day. All orders in this segment, including GTC/GTD orders, will be purged on the last day of the settlement.

(i). Trading Members are required to ensure that shares are duly registered in the name of the investor(s) before entering orders on their behalf on a trade date.

Salient Features of the Limited Physical Market

(a). Trading is conducted in the Odd Lot market (market type ‘O’) with Book Type ‘OL’ and series ‘BT’.

(b). Order quantities should not exceed 500 shares.

(c). The base price and price bands applicable in the Limited Physical Market are same as those applicable for the corresponding Normal Market on that day.

(d). Trading hours are the same as that of the normal market and order entry during the pre-open and post-close sessions are not allowed.

(e). Settlement for all trades would be done on a trade-for-trade basis and delivery obligations arise out of each trade.

(f). Orders get matched when both the price and the quantity match in the buy and sell order.

(g). Orders with the same price and quantity match on time priority i.e. orders which have come into the system before will get matched first.

(h). All Good-till-cancelled (GTC)/Good-till-date (GTD) orders placed and remaining as outstanding orders in this segment at the close of market hours shall remain available for next trading day. All orders in this segment, including GTC/GTD orders, will be purged on the last day of the settlement.

(i). Trading Members are required to ensure that shares are duly registered in the name of the investor(s) before entering orders on their behalf on a trade date.

The Reserve Bank of India had vide a press release on October 21, 1999, clarified that inter-foreign-institutional-investor (inter-FII) transactions do not require prior approval or post-facto confirmation of the Reserve Bank of India, since such transactions do not affect the percentage of overall FII holdings in Indian companies. (Inter FII transactions are however not permitted in securities where the FII holdings have already crossed the overall limit due to any reason).

To facilitate execution of such Inter-Institutional deals in companies where the cut-off limit of FII investment has been reached, the Exchange introduced a new market segment on December 27, 1999.

The securities where FII investors and FII holding has reached the cut-off limit as specified by RBI (2% lower than the ceiling specified by RBI) from time to time would be available for trading in this market type for exclusive selling by FII clients. The cut off limits for companies with 24% ceiling is 22%, for companies with 30% ceiling, is 28% and for companies with 40% ceiling is 38%. Similarly, the cut off limit for public sector banks (including State Bank of India) is 18% whose ceiling is 20%. The list of securities eligible / become ineligible for trading in this market type would be notified to members from time to time.

Salient Features of the Institutional segment

(a). Trading in this market segment is available for institutional investors only. In order to ensure that the overall FII ceiling limits are not violated, trading members shall be allowed to enter sell orders in this market segment only for their FII clients. However, members can enter buy orders on behalf of FII/FI clients.

(b). Trading takes place under series type ‘IL’ under market type ‘N’ The minimum tradable quantity in this market is 1.

(c). Trading shall be done on T+2 rolling settlement basis only. Settlement of transactions shall be on dematerialised mode only

(d). The base price and the price bands applicable for this segment are the same as those applicable for the corresponding normal market on that day.

(e). In case of buy/sell orders, members shall be required to enter the custodial participant code at the time of order entry. Members shall not be allowed the facility of trade warehousing for the IL Market segment.

To facilitate execution of such Inter-Institutional deals in companies where the cut-off limit of FII investment has been reached, the Exchange introduced a new market segment on December 27, 1999.

The securities where FII investors and FII holding has reached the cut-off limit as specified by RBI (2% lower than the ceiling specified by RBI) from time to time would be available for trading in this market type for exclusive selling by FII clients. The cut off limits for companies with 24% ceiling is 22%, for companies with 30% ceiling, is 28% and for companies with 40% ceiling is 38%. Similarly, the cut off limit for public sector banks (including State Bank of India) is 18% whose ceiling is 20%. The list of securities eligible / become ineligible for trading in this market type would be notified to members from time to time.

Salient Features of the Institutional segment

(a). Trading in this market segment is available for institutional investors only. In order to ensure that the overall FII ceiling limits are not violated, trading members shall be allowed to enter sell orders in this market segment only for their FII clients. However, members can enter buy orders on behalf of FII/FI clients.

(b). Trading takes place under series type ‘IL’ under market type ‘N’ The minimum tradable quantity in this market is 1.

(c). Trading shall be done on T+2 rolling settlement basis only. Settlement of transactions shall be on dematerialised mode only

(d). The base price and the price bands applicable for this segment are the same as those applicable for the corresponding normal market on that day.

(e). In case of buy/sell orders, members shall be required to enter the custodial participant code at the time of order entry. Members shall not be allowed the facility of trade warehousing for the IL Market segment.

SEBI vide circulars CIR/ IMD/FII&C/3/2012 dated January 13, 2012, CIR/ IMD/ FII&C/ 4/ 2012 dated January 25, 2012, provide a guideline for Investment by Qualified Foreign Investors (QFI) in Indian Equity Shares.

As per the SEBI circular, when the aggregate shareholding of all the QFIs in a company reaches 8% of the equity paid-up capital, the company’s name along with ISIN shall be published in caution list by the depositories and no fresh purchases shall be allowed without prior approval of the depositories. SEBI also advised Exchange to develop separate segment for Intra QFI transactions in the equity shares of companies in the caution list, if QFI wish to buy without the prior approval of the depositories.

To facilitate QFIs to trade in companies where the caution limit of QFI investment has been reached and QFI wish to buy without the prior approval of the depositories exchange has introduced new market segment w.e.f. March 20, 2012.

Salient Features of the Institutional QFI segment

(a). In order to ensure that the overall QFI ceiling limits are not violated, trading members shall be allowed to enter sell orders in this market segment only for their QFI clients.

(b). All other provisions applicable to different market segments (or type) shall also be applicable mutatis-mutandis to this market also.

(c). QFI transactions in IQ series executed on behalf of Qualified Foreign Investors shall be cleared and settled on a net obligations basis within the sub-segment. The settlement of all transactions shall compulsorily be done in dematerialised mode only. All transactions in IQ series shall be settled under settlement type ‘N’. Settlement Guarantee shall be provided.

(d). A cash market member may trade and settle the transactions done on behalf of QFIs based on the client codes. The assessment and collection of STT on such trades (EQ and IQ segment) will have to be at the rate applicable to delivery based transactions.

(e). All other provisions viz. confirmation timings, penalties, shortages etc. pertaining to IL series shall apply mutatis mutandis to IQ series.

As per the SEBI circular, when the aggregate shareholding of all the QFIs in a company reaches 8% of the equity paid-up capital, the company’s name along with ISIN shall be published in caution list by the depositories and no fresh purchases shall be allowed without prior approval of the depositories. SEBI also advised Exchange to develop separate segment for Intra QFI transactions in the equity shares of companies in the caution list, if QFI wish to buy without the prior approval of the depositories.

To facilitate QFIs to trade in companies where the caution limit of QFI investment has been reached and QFI wish to buy without the prior approval of the depositories exchange has introduced new market segment w.e.f. March 20, 2012.

Salient Features of the Institutional QFI segment

(a). In order to ensure that the overall QFI ceiling limits are not violated, trading members shall be allowed to enter sell orders in this market segment only for their QFI clients.

(b). All other provisions applicable to different market segments (or type) shall also be applicable mutatis-mutandis to this market also.

(c). QFI transactions in IQ series executed on behalf of Qualified Foreign Investors shall be cleared and settled on a net obligations basis within the sub-segment. The settlement of all transactions shall compulsorily be done in dematerialised mode only. All transactions in IQ series shall be settled under settlement type ‘N’. Settlement Guarantee shall be provided.

(d). A cash market member may trade and settle the transactions done on behalf of QFIs based on the client codes. The assessment and collection of STT on such trades (EQ and IQ segment) will have to be at the rate applicable to delivery based transactions.

(e). All other provisions viz. confirmation timings, penalties, shortages etc. pertaining to IL series shall apply mutatis mutandis to IQ series.

The scrips in Trade for Trade segment are made available for trading under BE series. The settlement of scrips available in this segment is done on a trade for trade basis and no netting off is allowed. The criteria for shifting scrips to/from Trade for Trade segment are decided jointly by the Stock Exchanges in consultation with SEBI and reviewed periodically.

The process of identifying the securities moving to Trade for Trade segment is done on a fortnightly basis while securities moving to/from Trade to Trade is done on a quarterly basis. This review is applicable to all securities irrespective of Price Bands.

The process of identifying the securities moving to Trade for Trade segment is done on a fortnightly basis while securities moving to/from Trade to Trade is done on a quarterly basis. This review is applicable to all securities irrespective of Price Bands.

Following are the features of Block Trades :

(1). Trading will be conducted in the Odd Lot market (market type ‘O’) with Book Type ‘OL’ and series ‘BL’.

Session Timings:

a) Morning Block Deal Window: This window shall operate between 08:45 AM to 09:00 AM.

b) Afternoon Block Deal Window: This window shall operate between 02:05 PM to 2:20 PM.

Reference price:

a) Morning Block Deal Window: The reference price for the execution of block deals in this window shall be the previous day closing price of the stock.

b) The reference price for block deals in this window shall be the volume-weighted average price (VWAP) of the trades executed in the security in the cash segment between 01:45 PM to 02:00 PM. In case no trades are executed in the security in the cash segment between 01:45 PM to 02:00 PM, the reference price shall be considered as follows-

VWAP based on trades executed in the security between 9:00 am to 1:45 pm shall be taken as a reference price. For the computation of VWAP, the trades of pre-open / special pre-open session as the case may be shall also be considered.

In case VWAP is not available as per above, then the previous day’s adjusted close price/base price shall be considered as a reference price.

The Exchange shall calculate and disseminate/ broadcast the applicable price range for the execution of block deal between 02:00 PM to 02:05 PM on the trading terminal.

The minimum order size for the execution of trades in the Block deal window shall be Rs.10 Crore.

Orders will get matched when both the price and the quantity match for the buy and sell order. Orders with the same price and quantity will match on time priority i.e. orders which have come into the system before will get matched first.

Market orders are not allowed for the BL series.

The orders placed shall be within ±1% of the applicable reference price in the respective windows as stated above.

(1). Trading will be conducted in the Odd Lot market (market type ‘O’) with Book Type ‘OL’ and series ‘BL’.

Session Timings:

a) Morning Block Deal Window: This window shall operate between 08:45 AM to 09:00 AM.

b) Afternoon Block Deal Window: This window shall operate between 02:05 PM to 2:20 PM.

Reference price:

a) Morning Block Deal Window: The reference price for the execution of block deals in this window shall be the previous day closing price of the stock.

b) The reference price for block deals in this window shall be the volume-weighted average price (VWAP) of the trades executed in the security in the cash segment between 01:45 PM to 02:00 PM. In case no trades are executed in the security in the cash segment between 01:45 PM to 02:00 PM, the reference price shall be considered as follows-

VWAP based on trades executed in the security between 9:00 am to 1:45 pm shall be taken as a reference price. For the computation of VWAP, the trades of pre-open / special pre-open session as the case may be shall also be considered.

In case VWAP is not available as per above, then the previous day’s adjusted close price/base price shall be considered as a reference price.

The Exchange shall calculate and disseminate/ broadcast the applicable price range for the execution of block deal between 02:00 PM to 02:05 PM on the trading terminal.

The minimum order size for the execution of trades in the Block deal window shall be Rs.10 Crore.

Orders will get matched when both the price and the quantity match for the buy and sell order. Orders with the same price and quantity will match on time priority i.e. orders which have come into the system before will get matched first.

Market orders are not allowed for the BL series.

The orders placed shall be within ±1% of the applicable reference price in the respective windows as stated above.

Salient features of Post Close Session are as follows:

• Closing Session is available only in Normal Market Segment.

• Timings will be 3.40 PM to 4.00 PM

• Only market price orders are allowed.

• Trading will take place at single price i.e. close price of a security.

• Special Terms, Stop Loss and DQ orders are not allowed.

• Trades will be considered as Normal Market trades.

• The post close session facility is available to all the securities which are eligible for trading in Normal market in CM segment. However, if securities not traded in the normal market session will not be allowed to participate in the Closing Session.

• Closing Session is available only in Normal Market Segment.

• Timings will be 3.40 PM to 4.00 PM

• Only market price orders are allowed.

• Trading will take place at single price i.e. close price of a security.

• Special Terms, Stop Loss and DQ orders are not allowed.

• Trades will be considered as Normal Market trades.

• The post close session facility is available to all the securities which are eligible for trading in Normal market in CM segment. However, if securities not traded in the normal market session will not be allowed to participate in the Closing Session.

Pre-open session

your future education

starts now

The pre-open session is for a duration of 15 minutes i.e. from 9:00 am to 9:15 am. The pre-open session is comprised of Order collection period and order matching period. The price band applicable shall be same as normal market.

The order collection period of 8* minutes shall be provided for order entry, modification and cancellation. (* – System driven random closure between 7th and 8th minute). During this period orders can be entered, modified and cancelled.

The information like Indicative equilibrium / opening price of scrip, total buy and sell quantity of the scrip is disseminated on the NEAT+ Terminal to the members on real time basis.

Indicative NIFTY Index value & % change of indicative equilibrium price to previous close price are computed based on the orders in order book and are disseminated during pre-open session.

Order matching period starts immediately after completion of order collection period. Orders are matched at a single (equilibrium) price which will be open price.

The order matching happens in the following sequence:

(a). Eligible limit orders are matched with eligible limit orders

(b). Residual eligible limit orders are matched with market orders

(c). Market orders are matched with market orders

The order collection period of 8* minutes shall be provided for order entry, modification and cancellation. (* – System driven random closure between 7th and 8th minute). During this period orders can be entered, modified and cancelled.

The information like Indicative equilibrium / opening price of scrip, total buy and sell quantity of the scrip is disseminated on the NEAT+ Terminal to the members on real time basis.

Indicative NIFTY Index value & % change of indicative equilibrium price to previous close price are computed based on the orders in order book and are disseminated during pre-open session.

Order matching period starts immediately after completion of order collection period. Orders are matched at a single (equilibrium) price which will be open price.

The order matching happens in the following sequence:

(a). Eligible limit orders are matched with eligible limit orders

(b). Residual eligible limit orders are matched with market orders

(c). Market orders are matched with market orders

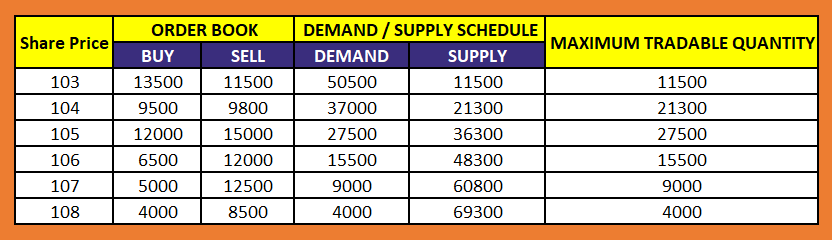

Equilibrium price determination

In a call auction price mechanism, equilibrium price is determined as shown below. Assume that NSE received bids for particular stock xyz at different prices in between 9:00 am and 9:15 am. Based on the principle of demand supply mechanism, exchange will arrive at the equilibrium price – the price at which the maximum number of shares can be bought / sold. In below example, the opening price will be 105 where maximum 27,500 shares can be traded.

During order matching period order modification, order cancellation, trade modification and trade cancellation is not allowed. The trade confirmations are disseminated to respective members on their trading terminals before the start of normal market. After completion of order matching there is a silent period to facilitate the transition from pre-open session to the normal market. All outstanding orders are moved to the normal market retaining the original time stamp.

FAQ

Special Pre-Open session

What type of orders are allowed in special pre-open session?

Only Limit orders are accepted

How is the order matching mechanism in this session?

(a). Order matching period will start immediately after completion of order collection period.

(b). Order will be matched at a single (equilibrium) price which will be open price.

(c). Eligible buy limit orders will be matched with eligible sell limit orders

(d). During order matching period order modification, order cancellation, trade modification and trade cancellation will not be allowed.

(e). The trade details will be disseminated to respective members immediately after matching of trades.

(b). Order will be matched at a single (equilibrium) price which will be open price.

(c). Eligible buy limit orders will be matched with eligible sell limit orders

(d). During order matching period order modification, order cancellation, trade modification and trade cancellation will not be allowed.

(e). The trade details will be disseminated to respective members immediately after matching of trades.

On what basis the opening price is determined?

(a). The opening price shall be determined based on the principle of demand and supply mechanism.

(b). The equilibrium price will be the price at which the maximum volume is executable.

(c). The equilibrium price determined in call auction of pre-open 2 session is considered as open price for the day

(b). The equilibrium price will be the price at which the maximum volume is executable.

(c). The equilibrium price determined in call auction of pre-open 2 session is considered as open price for the day

What if one or more price meets the criteria of determining the equilibrium price?

(a). In case more than one price meets the said criteria, the equilibrium price will be the price at which there is minimum order imbalance quantity (unmatched order quantity). The absolute value of the minimum order imbalance quantity will be taken into consideration.

(b). In case more than one price has same minimum order imbalance quantity, the equilibrium price will be the price closest to the base price. In case the base price is the mid-value of pair of prices which are closest to it, then the base price itself will be taken as the equilibrium price.

(b). In case more than one price has same minimum order imbalance quantity, the equilibrium price will be the price closest to the base price. In case the base price is the mid-value of pair of prices which are closest to it, then the base price itself will be taken as the equilibrium price.

Will operating range be flexed/relaxed in special pre-open session?

Yes, it shall be flexed in consultation with other Exchanges.

How operating range/dummy price band is flexed/relaxed during the session?

The Exchanges shall flex the operating range / dummy price bands in multiples of 10%.

What happens to unmatched orders which are entered in the call auction 2 session?

In case of IPO and SME IPO securities:

(a). All unmatched limit orders within applicable price range in the pre-open 2 session will be moved in the normal market session at their limit price on the basis of the price-time priority.

(b). This transfer will be done irrespective of equilibrium price discovered or not. In case of Re-listed Securities: In case of equilibrium price is determined, all unmatched orders within applicable price range will be moved to the normal market at their limit price on the basis of the price time priority

(a). All unmatched limit orders within applicable price range in the pre-open 2 session will be moved in the normal market session at their limit price on the basis of the price-time priority.

(b). This transfer will be done irrespective of equilibrium price discovered or not. In case of Re-listed Securities: In case of equilibrium price is determined, all unmatched orders within applicable price range will be moved to the normal market at their limit price on the basis of the price time priority

What happens if the equilibrium price is not discovered?

For IPO security:

(a). The security will move to normal market at the base price (issue price) of the security

For Relisted security:

(a). If the equilibrium price is not determined, all the orders shall cancelled by the system.

(b). Security will not be available for trading in normal market if equilibrium price is not determined in any of the Exchange

(c). The pre-open 2 session for the said security will be conducted on subsequent trading day. For stocks having derivatives contracts prior to undergoing corporate restructuring: In case equilibrium price is not discovered, all the outstanding orders shall be cancelled and the stock shall continue to trade in special pre-open session on the first day until the price is determined.

(a). The security will move to normal market at the base price (issue price) of the security

For Relisted security:

(a). If the equilibrium price is not determined, all the orders shall cancelled by the system.

(b). Security will not be available for trading in normal market if equilibrium price is not determined in any of the Exchange

(c). The pre-open 2 session for the said security will be conducted on subsequent trading day. For stocks having derivatives contracts prior to undergoing corporate restructuring: In case equilibrium price is not discovered, all the outstanding orders shall be cancelled and the stock shall continue to trade in special pre-open session on the first day until the price is determined.

Is there any price band applicable in this session?

(a). No Price bands are applicable in the special Pre-open session.

(b). However in order to prevent members from entering orders at non-genuine prices in such securities based on Pre-trade risk control guidelines, the Exchange sets the dummy circuit filter i.e. operating range

(b). However in order to prevent members from entering orders at non-genuine prices in such securities based on Pre-trade risk control guidelines, the Exchange sets the dummy circuit filter i.e. operating range

What is the dummy circuit filter/operating range in special pre-open session?

The initial dynamic price bands shall be set uniformly in co-ordination with other Exchanges in the range of 25% to 75% as the case may be.

Where shall I receive the information related to applicable base price?

Base price is visible in market inquiry screen (F11) on TWS in the field name “Close”.

What happens to my order if the order price is beyond the set/relaxed operating range?

It shall result in price freeze which shall be subsequently cancelled by Exchange

Periodic Call Auction

The Secondary Market Advisory Committee (SMAC), recommended the introduction of trading through

periodic call auction mechanism for illiquid scrips in the equity market extending the call auction mechanism in pre-open session

to all scrips.

Periodic Call Auction for Illiquid scrips

Trading in illiquid scrips in the equity market shall be conducted only through periodic call auction sessions.

Criteria for illiquidity

a) For the purpose of this circular, a scrip which trades in the normal market and is not shifted to trade for trade settlement, shall be classified as illiquid on a stock exchange if the following conditions are met

1. Average daily turnover of less than Rs.2 lakhs calculated for previous two quarters and

2. The scrip is classified as illiquid at all exchanges where it is traded

b) Of the scrips identified as per above criteria, scrips which satisfy any of the following conditions shall be excluded.

1. Scrips with average market capitalization more than Rs.10Cr.

2. Scrips where company is paying dividend in at least two out of last three years.

3. Scrips where company is profitable in at least 2 out of last 3 years, and not more than 20% of promoters shareholding is pledged in the latest quarter and book value is 3 times or more than the face value

1. Average daily turnover of less than Rs.2 lakhs calculated for previous two quarters and

2. The scrip is classified as illiquid at all exchanges where it is traded

b) Of the scrips identified as per above criteria, scrips which satisfy any of the following conditions shall be excluded.

1. Scrips with average market capitalization more than Rs.10Cr.

2. Scrips where company is paying dividend in at least two out of last three years.

3. Scrips where company is profitable in at least 2 out of last 3 years, and not more than 20% of promoters shareholding is pledged in the latest quarter and book value is 3 times or more than the face value

Entry into periodic call auction mechanism

Stock exchanges shall identify illiquid scrips at the beginning of every quarter and move such scrips to periodic call auction mechanism.

Exit from periodic call auction mechanism

Stock exchanges shall move scrips from periodic call auction mechanism to normal trading session if the following criteria are met:

The scrip has remained in periodic call auction for at least one quarter.

The scrip has remained in periodic call auction for at least one quarter.

Un-matched orders-

The orders may remain valid throughout the trading day and un-matched orders remaining at the end of a call auction session may be moved into next call auction session.”

Price band

A maximum price band of 20% shall be applicable on the scrips through the day. Exchanges may reduce the price bands uniformly based on surveillance related concerns.

Penalty for certain trades

In the event where maximum of buy price entered by a client (on PAN basis) is equal to or higher than the minimum sell price entered by that client and if the same results into trades, a penalty shall be imposed on such trades. The penalty shall be calculated and charged by the exchange and collected from trading members on a daily basis. Trading members may recover such penalty from clients.

Notice to market

For entry and exit of scrips in the call auction mechanism, a notice of two trading days shall be given to the market.

Number of auction sessions

Periodic call auction sessions of one hour each shall be conducted throughout the trading hours with the first session starting at 9:30am. Stock Exchange may determine the number of call auction session for illiquid stocks. However in order have minimum trading sessions and uniform closing session, there shall be at least 2 sessions in a trading day with one uniform closing session across the exchanges.”

Session duration

The call auction session duration shall be one hour, of which 45 minutes shall be allowed for order entry, order modification and order cancellation, 8 minutes shall be for order matching and trade confirmation and remaining 7 minutes shall be a buffer period for closing the current session and facilitating the transition to next session. The session shall close randomly during last one minute of order entry between the 44th & 45th minute. Such random closure shall be system driven.

Circuit Breaker

If the Market wide Index Circuit Breaker gets triggered at any time during the periodic call auction session, the session shall be cancelled and all orders shall be purged. The periodic call auction session shall be resumed at the nearest half hour after the normal market resumes.

Securities Available for Trading

The Capital Market (Equities) segment of NSE facilitates trading in the following instruments:

-

Shares :-

a) Equity Shares

b) Preference Shares -

Debentures

a. Partly Convertible Debentures

b. Fully Convertible Debentures

c. Non Convertible Debentures

d. Warrants / Coupons / Secured Premium Notes/ other Hybrids

e. Bonds - Units of Mutual Funds

Circuit Breakers

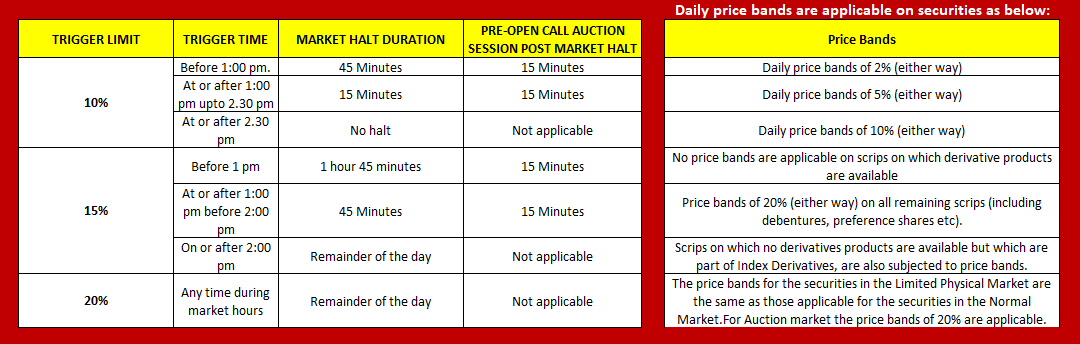

The Exchange has implemented index-based market-wide circuit breakers with effect from July 02, 2001 based on SEBI Circular No. SMDRPD/Policy/Cir-37/2001 dated June 28, 2001. SEBI vide its Circular no. CIR/MRD/DP/ 25 /2013 dated September 03, 2013 has partially modified the earlier circular. The revised guidelines are as below.

The index-based market-wide circuit breaker system applies at 3 stages of the index movement, either way viz. at 10%, 15% and 20%. These circuit breakers when triggered bring about a coordinated trading halt in all equity and equity derivative markets nationwide.

The market-wide circuit breakers are triggered by movement of either the BSE Sensex or the Nifty 50, whichever is breached earlier. In this regard the Exchange has issued a circular no 85/2013 (Download No-24709) dated October 11, 2013.

The market shall re-open, after index based market-wide circuit filter breach, with a pre-open call auction session. The extent of duration of the market halt and pre-open session is as given below:

The index-based market-wide circuit breaker system applies at 3 stages of the index movement, either way viz. at 10%, 15% and 20%. These circuit breakers when triggered bring about a coordinated trading halt in all equity and equity derivative markets nationwide.

The market-wide circuit breakers are triggered by movement of either the BSE Sensex or the Nifty 50, whichever is breached earlier. In this regard the Exchange has issued a circular no 85/2013 (Download No-24709) dated October 11, 2013.

The market shall re-open, after index based market-wide circuit filter breach, with a pre-open call auction session. The extent of duration of the market halt and pre-open session is as given below:

Trader Workstation

The trader workstation is the terminal from which the member accesses the trading system. Each trader has a unique identification by way of Trading Member ID and User ID through which he is able to log on to the system for trading or inquiry purposes. A member can have several user IDs allotted to him by which he can have more than one employee using the system concurrently.

The Exchange may also allow a Trading Member to set up a network of dealers in different cities all of whom are provided a connection to the NSE central computer. A Trading Member can define a hierarchy of users of the system with the Corporate Manager at the top followed by the Branch Manager and Dealers

The Exchange may also allow a Trading Member to set up a network of dealers in different cities all of whom are provided a connection to the NSE central computer. A Trading Member can define a hierarchy of users of the system with the Corporate Manager at the top followed by the Branch Manager and Dealers

The title bar displays the current time, Trading system name and date.

A window with different icons which provides quick access to various functions such as Market By Order, Market By Price, Market Movement, Market Inquiry, Auction Inquiry, Snap Quote, Market Watch, Buy order entry, Sell order entry, Order Modification, Order Cancellation, Outstanding Orders, Order Status, Activity Log, Previous Trades, Net Position, Online Backup, Supplementary Menu, Security List and Help. All these functions are also available on the keyboard.

The ticker displays information about a trade as and when it takes place. The user has the option to set-up the securities which appear in the ticker.

The Market Watch window is the main area of focus for a Trading Member. The purpose of Market Watch is to view market information of pre-selected securities that are of interest to the Trading Member.

To monitor various securities, the trading member can set them up by typing the Security Descriptor consisting of a Symbol field and a Series field. Securities can also be set up by invoking the Security List and selecting the securities from the window. The Symbol field incorporates the Company name and the Series field captures the segment/instrument type. A third field indicates the market type.

For example,

Company (Symbol) : ACC

Instrument type (Series): EQ

Market Type: N

For each security in the Market Watch window, market information is dynamically updated on a real time basis. The market information displayed is for the current best price orders available in the regular lot book. For each security, the corporate action indicator (e.g., Ex or cum dividend, interest, rights etc.), the total buy order quantity for the best buy price, best sell price, total sell order quantity for the best sell price, the Last Traded Price (LTP), the last traded price change indicator (‘+’ if last traded price is better than the previous last traded price and ‘-‘ if it is worse) and the no delivery indicators are displayed. If the security is suspended, “SUSPENDED” appears in front of the security.

To monitor various securities, the trading member can set them up by typing the Security Descriptor consisting of a Symbol field and a Series field. Securities can also be set up by invoking the Security List and selecting the securities from the window. The Symbol field incorporates the Company name and the Series field captures the segment/instrument type. A third field indicates the market type.

For example,

Company (Symbol) : ACC

Instrument type (Series): EQ

Market Type: N

For each security in the Market Watch window, market information is dynamically updated on a real time basis. The market information displayed is for the current best price orders available in the regular lot book. For each security, the corporate action indicator (e.g., Ex or cum dividend, interest, rights etc.), the total buy order quantity for the best buy price, best sell price, total sell order quantity for the best sell price, the Last Traded Price (LTP), the last traded price change indicator (‘+’ if last traded price is better than the previous last traded price and ‘-‘ if it is worse) and the no delivery indicators are displayed. If the security is suspended, “SUSPENDED” appears in front of the security.

With every trade in a security participating in Index, the user has the information on the current value of the Nifty. This value is displayed at the extreme right hand corner of the ticker window.

Index Inquiry gives information on Close, Open, High, Low and current index values at the time of invoking this inquiry screen.

Index Inquiry gives information on Close, Open, High, Low and current index values at the time of invoking this inquiry screen.

The Snap Quote feature allows a Trading Member to get instantaneous market information on any desired security. This is normally used for securities that are not already on display in the Market Watch window. The information presented is the same as that of Market Watch window.

Order entry mechanisms enable the Trading Member to place orders in the market. The system will request re-confirmation of an order so that the user is cautioned before the order is finally released into the market. Orders once placed on the system can be modified or cancelled till they are matched. Once orders are matched they cannot be modified or cancelled.

There is a facility to generate online order/trade confirmation slips as soon as an order is placed or a trading is done. The order confirmation slip contains among other things, order no., security name, price, quantity, order conditions like disclosed or minimum fill quantity etc.

The trade confirmation slip contains the order and trade no., date, trade time, price and quantity traded, amount etc. Orders and trades are identified and linked by unique numbers so that the investor can check his order and trade details.

There is a facility to generate online order/trade confirmation slips as soon as an order is placed or a trading is done. The order confirmation slip contains among other things, order no., security name, price, quantity, order conditions like disclosed or minimum fill quantity etc.

The trade confirmation slip contains the order and trade no., date, trade time, price and quantity traded, amount etc. Orders and trades are identified and linked by unique numbers so that the investor can check his order and trade details.

This window is used to view messages from the Exchange to all specific Trading Members.

Some of the supplementary features in the NEAT system are:

• On line back up

An on line back up facility is provided which the user can invoke to take a back up of all order and trade related information. There is an option to copy the file to any drive of the computer or on a floppy diskette. Trading members find this convenient in their back office work.

• Off Line Order Entry

A member is able to make an order entry in the batch mode.

• On line back up

An on line back up facility is provided which the user can invoke to take a back up of all order and trade related information. There is an option to copy the file to any drive of the computer or on a floppy diskette. Trading members find this convenient in their back office work.

• Off Line Order Entry

A member is able to make an order entry in the batch mode.